摘要: Why earlier generations of algorithmic stable coins are not working, and how we solved the problems

The Death Spiral of algorithmic stable coin

Basis Cash and many earlier algorithmic stable coins ask investors to hold their tokens by giving them more. This is basically the worst choice that they can make. It‘s because of:

- The big players have almost unlimited control over the minting of tokens and can produce tokens at near-zero cost.

- The demand for token becomes unit elastic, in response to changes in the value and price of token (1/P)

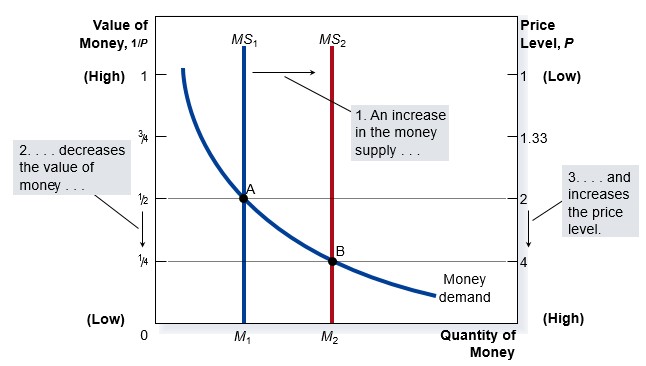

Here’s how the money supply and demand graph looks like:

Their minting policy has switched from influencing the demand for the MOA (under the USD standard), to a policy of influencing the supply of the MOA (although money demand is also affected by market confidence.) When the price of an algorithmic stable coin fall under 1 usd, it means that the market is losing confidence in it. The projected value of such token will be highly influenced by the market price. When the price enters into a death spire, the low demand will cause higher supply, thus lower the demand. The price of such token will never recover as the investors losing the confidence in them.

Quantity Theory of Money (QTM)

The Quantity Theory of Money tells of how the price level is determined and why it might change over time.

- The quantity of money available in the economy determines the value of money, and consequently the primary cause of inflation is the growth in the quantity of money

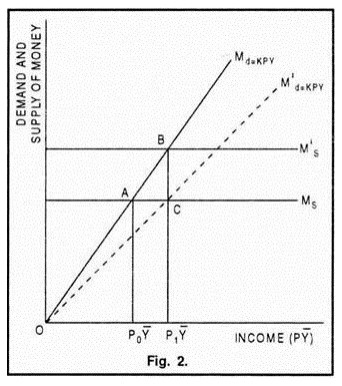

- Basically we have M V = P Y

where: V = velocity; P = the price level; Y = the quantity of output; M = the quantity of money

- The quantity equation relates the quantity of money (M) to the nominal value of output (P x Y). The quantity equation shows that an increase in the quantity of money in an economy must be reflected in one of three other variables: the price level must rise, the quantity of output must rise, or the velocity of money must fall.

- The velocity of money is relatively stable over time. So when the central bank changes the quantity of money, it causes proportionate changes in the nominal value of output (P x Y); That is, the general price rises as money does not affect real output (because money is neutral) and so we have inflation.

In fiat economy, hyperinflation is inflation that exceeds 50 percent per month. Hyperinflation occurs in some countries because the government prints too much money to pay for its spending.

- When a token raises market cap by printing more, it is said to levy an inflation tax. An inflation tax is like a tax on everyone who holds that token.

- By giving them more to compensate for their loss, will only accelerate the loss of confidence.

- The Fisher effect refers to a one-to-one adjustment of the nominal interest rate to the inflation rate.

According to the Quantity Theory of Money, when the rate of inflation rises, the nominal interest rate rises by the same amount. The real interest rate stays the same. in brief, Sigma protocol is able to balance the circulating speed and inflation rate of SASH (Sigma Cash). SASH will be mint when the market demands more, and vice versa.

The ultimate goal of SASH is being sustainable, but not fixed.

▲Sigma Cash (SASH) is not another algorithmic stable coin(來源:debond-protocol.medium.com)

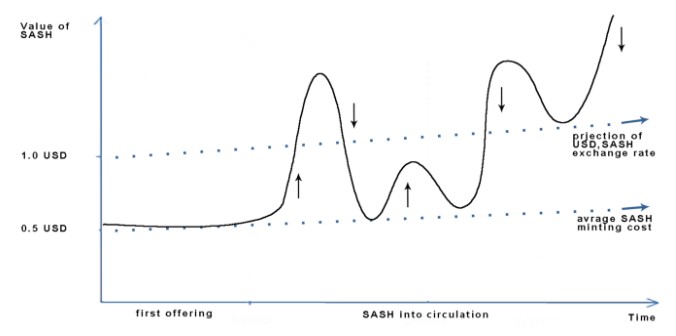

SASH(Sigma Cash) is “sustainable” and partially collateralized. The price of SASH is baked partially by USD based stable coins such as BUSD. The minimum minting cost of SASH is 0.5 USD at the start. Meaning that the price of SASH will never fall below 0.5USD.

The partial pledge of SASH will be more or less like the gold standard of British pound, which was abandoned in the 20th century. In simple words, the lowest price of SASH is backed by usd. This lower limit will keep rising as more SASH are being mint. When the Bonds market is open, SASH as the only settlement currency will be more demanded by the market. It’s price can easily skyrocketed. So it has no upper limit.

SASH is bond based, SASH bondholders will never suffer from permanent or impermanent loss.

SASH are minted only from bond redemption. Investors can deposit a stable coin into a bank contract to receive bonds. By doing so, SASH contract will mint the same amount of SASH as stable coin deposit. This will influence the market demand of SASH. Every time when an investor buy SASH bond, the price of SASH will move slightly toward its projected price (starts from 1 USD). If the price of SASH is much higher than this projected price, the profit rate of SASH bonds will grow accordingly. More demand of SASH bond will accelerate the price adjustment of SASH,

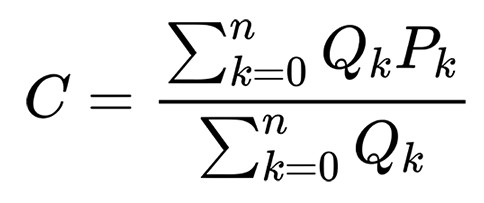

When the bond are redeemed, a part of the bondholder’s principal will be used as the pledge of the SASH minted, and it will be transferred to swap LP. In this sense the total value and price of SASH will never fall under the total value of the pledge token. This mechanism allows the speculators to buy SASH when the price falls near to the lower limit. The lower limit of SASH depends on the average minting cost of SASH. Average minting Cost(C) is calculated from the sum of the total value of every SASH bonds issued(Quantity*Price)dived by the total number of SASH bonds issued.

Because the staking for SASH is single stable coin based, there will be no permanent or impermanent loss. When the bonds is redeemed, investors will receive twice the USD they deposited. Because the price of SASH will never fall under 0.5 USD, investor of SASH bond will never suffer from any loss.

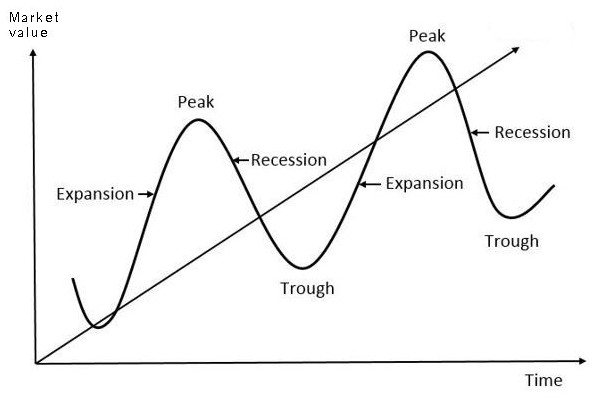

SASH is Death Spiral resistant, it can always recover from recession.

SASH bonds work like national debt. The bondholders get profit from the expansion of the market. And like any economic cycle, when the market is in recession, the low circulating speed of money will make debt more difficult to claim. Bonds of those debts will be less wanted in the secondary market. In the case of SASH bonds, because of the value of the pledge token locked in the LP, speculators will much willingly buy bonds from desperate earlier bond holders, at a very low price.

In any economic system, bad debt will be eventually remitted by bankruptcy, mergers & acquisitions, state and bank intervention. When whales collect enough low cost bonds, they can burn a part of the bond and reclaim the interest and principle of the bond bought from LP. All kinds of bonds can only be bought with SASH. This will allow the market demand of SASH to push the price of SASH to a new high. New money will be attracted by the high interest of SASH bonds. Thus SASH will always recover from recession.

Why are we doing this?

The real tragedy of our century is that when the promise of an equal society is still echoing in the ear, we are witnessing the biggest wave of social polarization since the invention of money. There are many governments who have come to grips with the problem of inflation caused by their regulatory policy. But they still believe that the economic growth will engulf the extra supply circulating in their domestic markets. Economic expansion, as such, gives too glamorous pictures of an imaginary utopia, like which the crisis and recession can be easily maintained by government interventions. The Austrian economists aware us of the danger of a planned socialist economy and exposed us in a cruel way to the fact that if the supply and demand can’t be translated into the objective information necessary for rational allocation of resources in society, any economic planning necessarily leads to an irrational and inefficient allocation of resources. In market exchanges, prices reflect the supply and demand of resources, labor and products. The bureaucratic or technocratic methods of regulations during the recession period are disturbing the natural cycle of economy, and will inevitably lead us to some greater crises in the future.

We can regard the coming of the centralization of wealth as an unavoidable result of the evolution of the relation of production. But one must at least concede to the fact, that the distribution mechanism must advance with the invention and application of newer technologies and the mode of production. The capitalist bias is so great that we consider that currency intervention is a remedy to any economic problem. Hayek in his later work Denationalization of Money proposed a decentralized ledger intended to find a better suited solution to compensating the fiat money. We are building this model today to prove his theory.

In that sense, we are not seeking for any profit, Sigma Protocol is a community project. The distribution of SASH is fair for all, No pre-sale, no pre-mine, no team share.

轉貼自Source: debond-protocol.medium.com

若喜歡本文,請關注我們的臉書 Please Like our Facebook Page: Big Data In Finance

留下你的回應

以訪客張貼回應