摘要: This article was contributed from FlexTrade.1 “How should I determine which orders can be auto-routed?”2 “How many orders do I need in order to accurately evaluate the performance of my algo wheel destinations?”

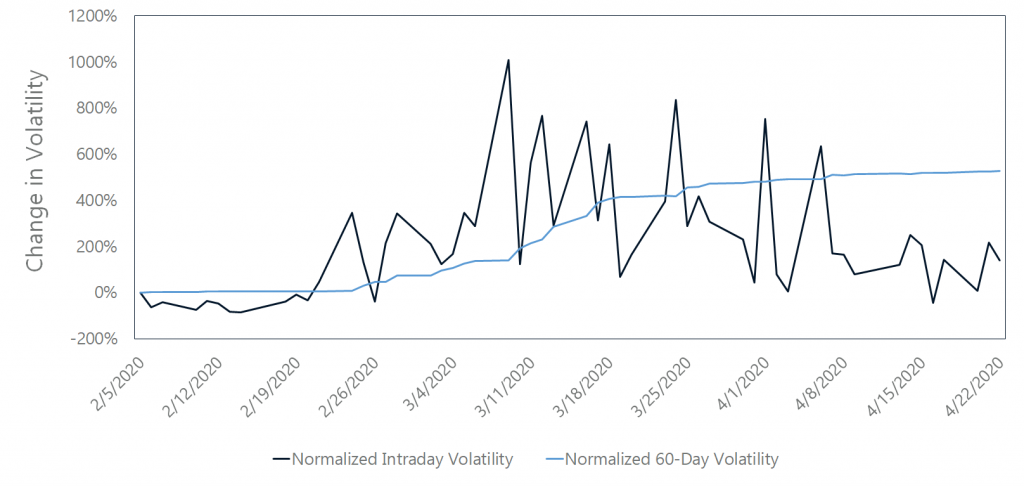

Intraday and 60-Day Volatility in SPY

The recent crisis with the global pandemic, and the corresponding shift in the market regime in US equities underscores one important metric to consider when answering both of these questions – intraday volatility. Figure 1 shows a comparison of the relative changes in FlexTrade’s proprietary intraday volatility metric (based on the variance of intraday returns) versus a more traditional 60-day volatility metric (based on the standard deviation of close-on-close returns). We’ve used the symbol SPY as an example, but similar trends hold across US equities.

As can be clearly seen:

The intraday volatility metric responds to the regime much more rapidly than the historic measure.

......

詳見全文Full Text: tradersmagazine

若喜歡本文,請關注我們的臉書 Please Like our Facebook Page: Big Data In Finance

留下你的回應

以訪客張貼回應