▲圖片來源:medium.com

The current iteration of popular NFT projects revolves around staking and disbursement of unique tokens. It’s (almost) all a scam. A very small number of projects can make this work, whether through an extended Ponzi/pyramid combination, or sustainably with actual revenue generation.

In general, I will try never to fud an individual project, but I will use some basic numbers from the projected tokenomics of a recently rugged project to show why staking for proprietary tokens is busted. Hopefully, it can be clear enough that we can all stop falling for the same trick over and over. I am very grossly oversimplifying this so that most anyone trading NFTs can understand without any complex finance/trading background.

Suppose you have a very exciting project with a supply of 5,000 and a mint price of 1 Solana. The project is hyped to outer space, and fully sells out just like everyone expects. The creators of the project pocket 5,000 Solana. In the midst of the sellout excitement, they announce that their NFTs can be staked, and stakers will get paid out daily in their token. Passive income, right? Absolutely not.

Let’s assume the project creators don’t immediately rug and follow through on building their staking platform. They promise the “biggest liquidity pool [LP] of any NFT token on Solana” by pledging 4,000 of the 5,000 Sol (80% of the total) that they made in the mint to backing the LP. How much are all their tokens now worth? It’s slightly more complicated than this, but effectively all the tokens that will ever be distributed are worth a total of 4,000 Solana. They are simply taking 80% of the money the community put in to pay back out. If you paid 1 Solana for your NFT, over the staking period for the token, you will make roughly 0.8 Solana worth of token. So you get paid back 80% of your investment… eventually… as long as you stake it and don’t sell. Sweep, delist, HODL, passive income, raise the floor!

Now let’s make the deal sound even sweeter. Suppose that project did 20,000 Solana of secondary sales volume in the first couple days. They had massive sales volume because of their token staking announcement and the floor price pumped to 4 Solana (this is from our actual example, except they had slightly less volume and floor was slightly higher). Imagine they even say, “hey guys, we’re going to put 100% of secondary sales royalties into the LP so the token is even more valuable!” Now we’re rich, right? Still no.

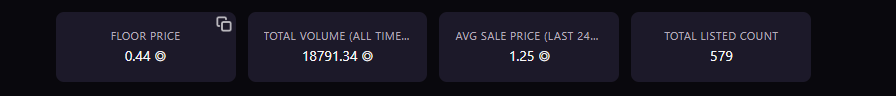

▲This is shortly post-rug. Prior to the rug, a healthy floor was consolidating above 4 Solana.(來源:medium.com)

Let’s be super generous and fabricate some numbers. Pretend they have a 10% royalty, and they have 100,000 Solana of volume. They will take 0.1 x 100,000 = 10,000 Solana and add it to the LP. So the token is now basically backed by the 4,000 initial, and 10,000 more. So 14,000 Sol/5,000 NFT = 2.8 Sol/NFT for staking your token for… months? But you can sell now for 4 Sol (probably more if they have 100k volume)? Why should I buy in at 4 Sol if all the tokens I ever get will be worth less than 4 Sol? What gives?

The fundamental problem with NFT staking for tokens is this: you are getting paid from the money you already put in. If the devs take ANY profits from their project, you are already losing. Royalties dilute the pool because only a small percentage of the funds might eventually fund the LP, and the people buying in after mint have no chance of recovering their cost with staking tokens because the typical buy in will always be much higher than the payout.

▲Google already knows about NFT staking tokens somehow, just calls it something else.(來源:medium.com)

So how can an NFT token be successful? In a very basic sense there are 2 functioning models.

- The Bad. What I call the “pyramid on ponzi” model, aka make a Gen 2. You give your tokens a temporary utility and you get some more money into the pool by making a gen 2 and bring a bunch more people, along with their funds, into the project. The base layer of the pyramid benefits as their tokens maintain value a bit longer. The new people are excited to be in a hype project, only to find that after the hype dies down they are getting nothing and things are eventually going to zero. A small handful of projects can live like this (we will stand to see their lifespan because it’s so early), but the vast majority will have relatively quick runs to zero.

- The Good. External revenue generation. This is the sustainable one. Basically the token is backed by external revenue that is sustainable, not just selling more NFTs piggybacking on the hype of the original project. This is the model Shadowy Super Coder (SSC) and Yawww Quantum Traders use, and why SSC (whose staking is already live) is considered one of the gold standards in NFT staking. They have businesses that generate revenue in a sustainable way, and that revenue is used to maintain and increase the value of their token over time. Utility is certainly a bonus, but the crux of this is that the token is exchangeable for more and more of an asset that is actually liquid (Eth, Sol, USDC, etc).

So what are you holding in your NFT wallets? Are your projects’ tokenomics sustainable? Do your projects make actual money and use it to make their tokens more valuable? Or are you getting scammed by the illusion of passive income? Ask yourself these questions instead of asking “wen staking?”

I want to be clear, there is plenty of money to be made flipping these projects. There is a lot of desperation for money in this space, and the dream of passive income is EXTREMELY attractive. People will buy these things from you for silly prices because “staking is live immediately after mint.” I’m not trying to fud your bags. Buy and sell and grow. Please just understand that what we are being sold by most of these projects is a slow bleeding Ponzi scheme, and know better than to “sweep and delist for the passive.”

轉貼自Source: medium.com

若喜歡本文,請關注我們的臉書 Please Like our Facebook Page: Big Data In Finance

留下你的回應

以訪客張貼回應