摘要: The short answer to this question is: It depends! The longer answer is different for different investors and trading signals. That, in turn, means issues like long queues, invested venues and speed bumps matter more (or less) depending on how you need to trade.

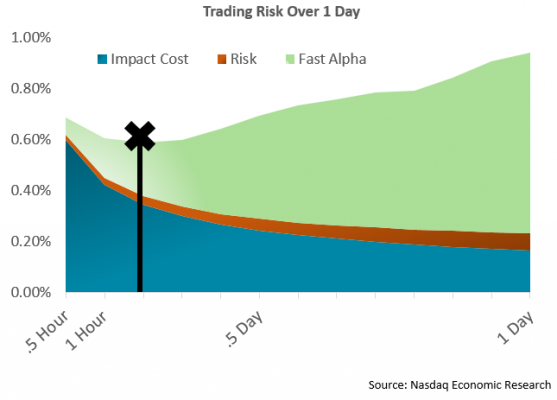

Trading is a trade-off We’ve talked before about how trading is a trade-off.

Trade too fast, and you increase your costs, which reduces the investment returns you capture.

Trade too slow, and you may miss liquidity at good prices only to see stock prices move away from your entry price. That also reduces returns.

......

Most research shows that costs increase as size, volatility and spreads increase. That’s consistent with ITG data showing that average large-cap shortfall costs in the U.S. are around 30 basis points (bps) per trade while small-cap stocks with wider spreads and higher volatility cost about 80 bps per trade.

......

But this is also important to the debate around speed bumps and hidden orders. Both incur opportunity costs, such as fading or missing some fills. That can be positive for slow alpha orders, as it should reduce trade costs over time. But for trades with higher alpha, that missed liquidity can be expensive. For the provider, avoiding “adverse selection” means missing fills on the near touch. For a taker, it means lower fulfillment while increases the costs of trading too.

留下你的回應

以訪客張貼回應