摘要: Recently, Two Sigma’s David Kriegman from AI Core Team gave a webinar and discussed how researchers apply deep learning to sequences in quantitative investing.

Recently, Two Sigma’s David Kriegman from AI Core Team gave a webinar and discussed how researchers apply deep learning to sequences in quantitative investing. David Kriegman is currently a professor of computer science and engineering at University of California, San Diego. He joined Two Sigma since January 2021.

▲Two Sigma

Quantitative investing seems to be a blackbox to most people and it continues to grow in complexity. According to the company’s website, Two Sigma, as well as other companies, applies deep learning to sequences in quantitative investing based on a large amount of financial data.

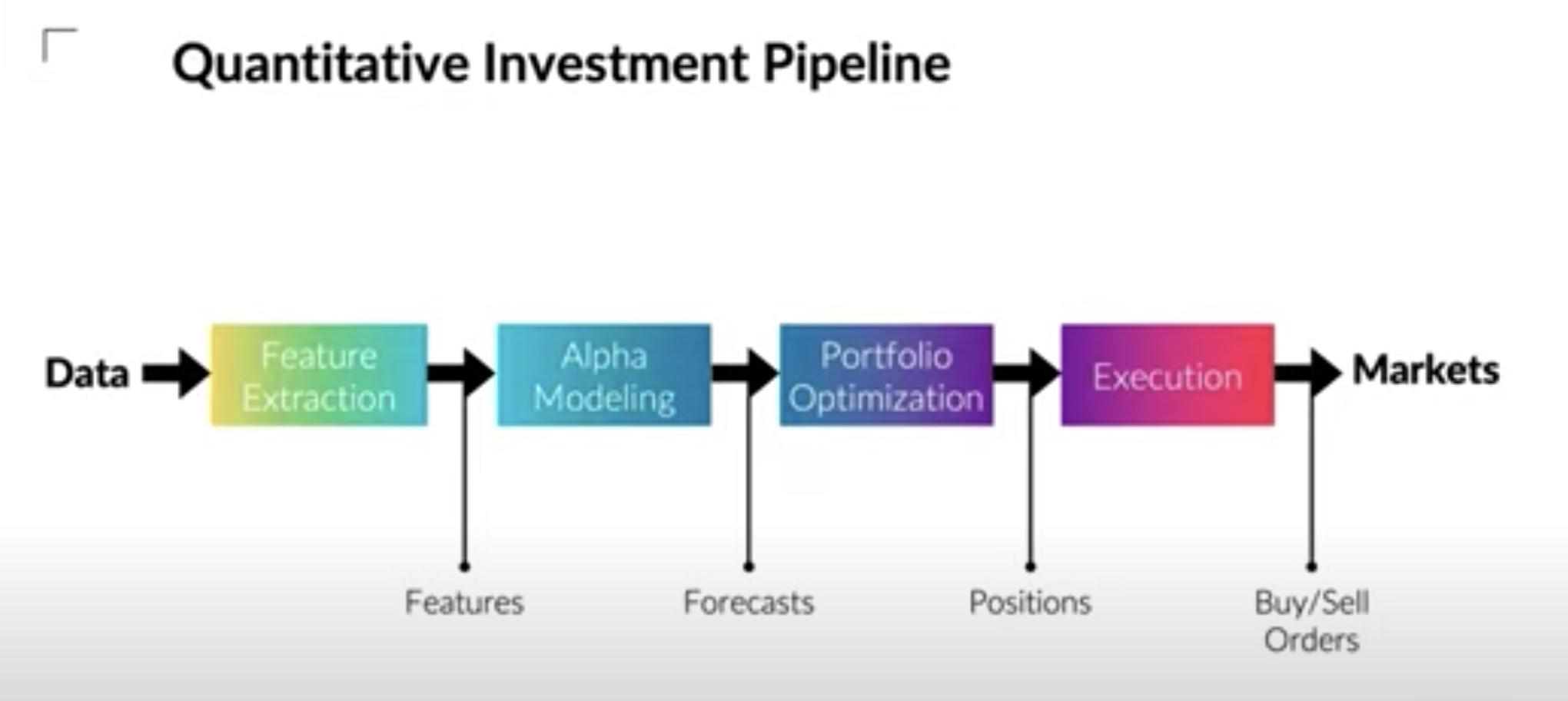

As Prof Kriegman explains, the process naturally decomposes into steps of feature extraction, forecasting the returns of individual instruments, portfolio allocation to decide quantities to trade, and trading execution. Many of the steps in this process are readily expressed as machine learning problems that can be addressed using deep learning sequence methods.

▲Source: Two Sigma

In the webinar, it breaks down into two major parts: the first part introduces the workflow of Two Sigma’s quantitative investment, and the connection between each part and deep learning; the second part introduces some common deep learning models that are used in sequence prediction.

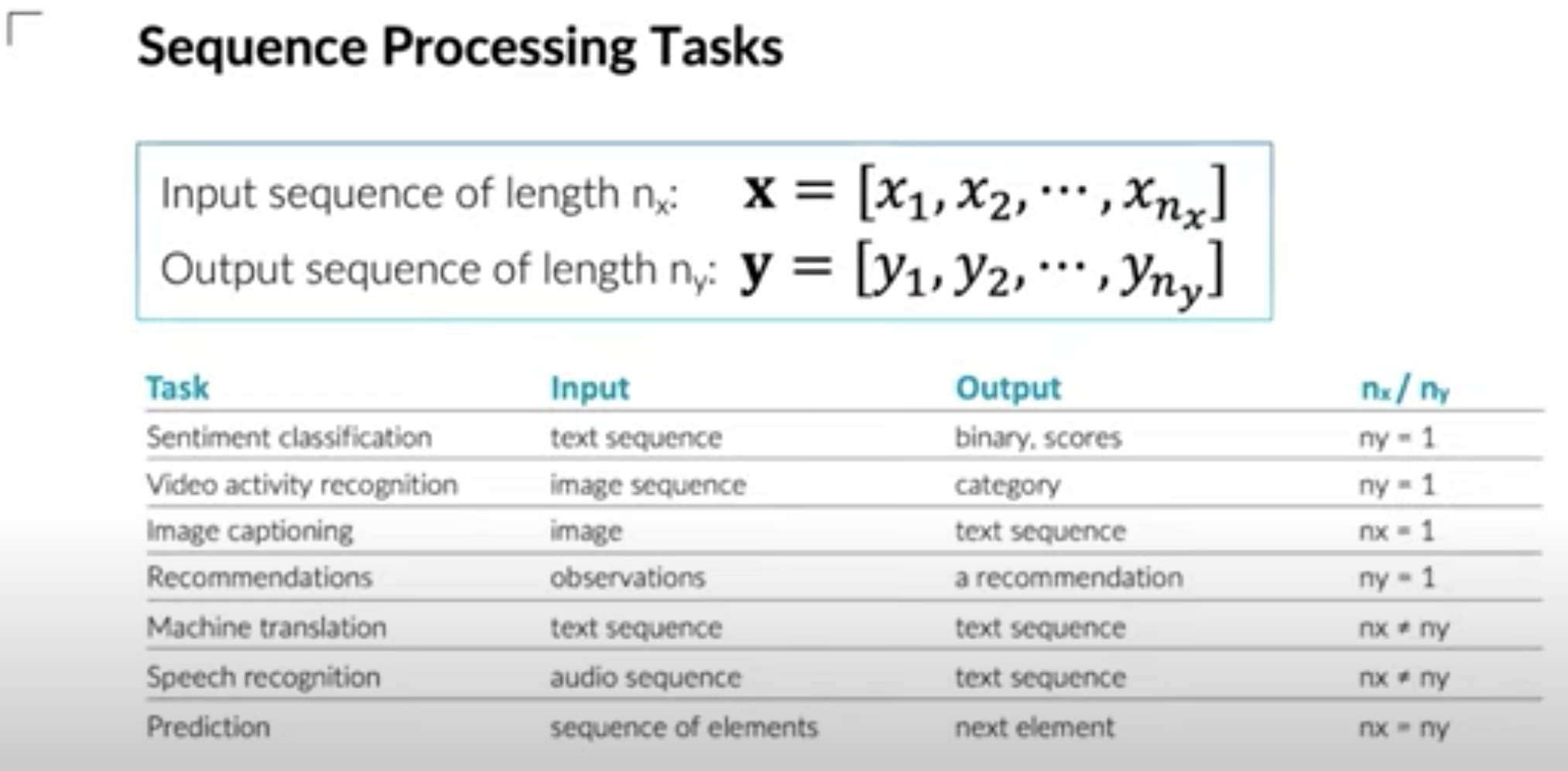

The traditional factor investment framework has the following major steps:

- Feature extraction

- Alpha Modeling

- Portfolio Optimization

- Execution

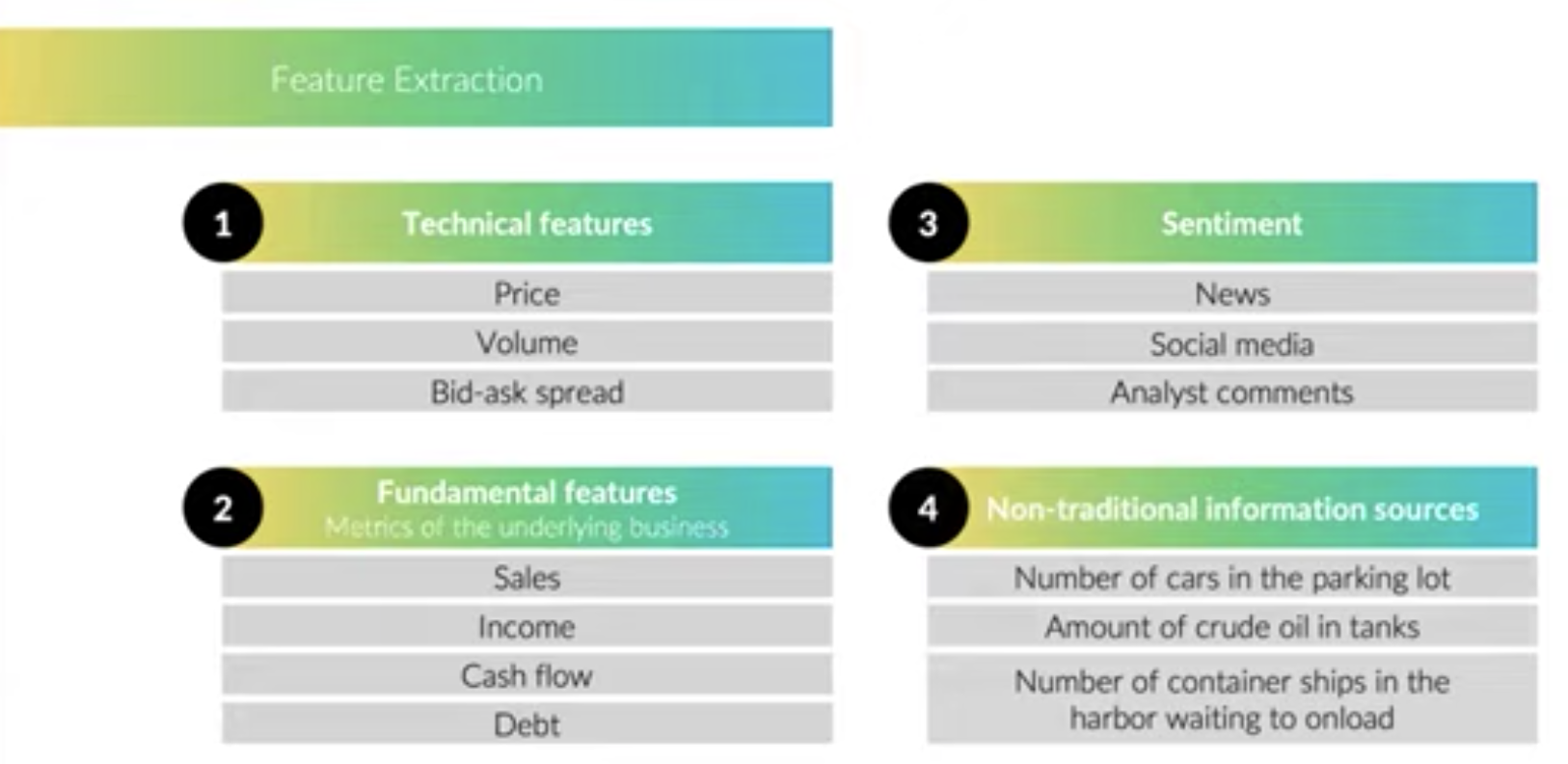

In Feature Extraction and Alpha Modeling, the original input of factors can come from a bunch of different sources, such as technical features, fundamental data, sentiment as well as alternative data. From a large amount of data, alpha models are constructed to predict the future return of each individual asset class via sequential deep learning. All of these issues can be expressed as a large-scale optimization problem.

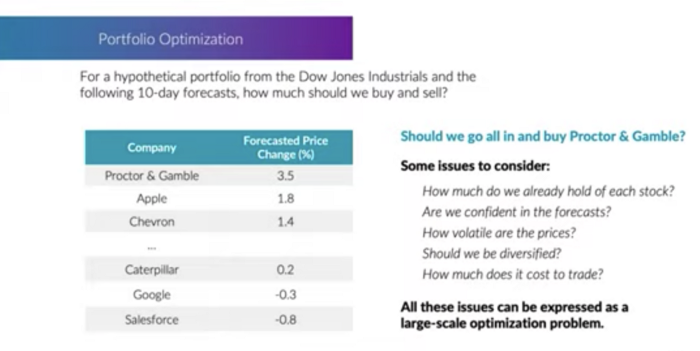

After having the return prediction of each individual asset, the next step is to build the portfolio. The quantitative researchers need to determine the allocation for each asset in the portfolio. Although it is not a sequential prediction problem, there are a lot of machine learning algorithms can be implemented in the portfolio optimization, as there are a lot of constraints to be considered, as well as choosing the suitable objective function.

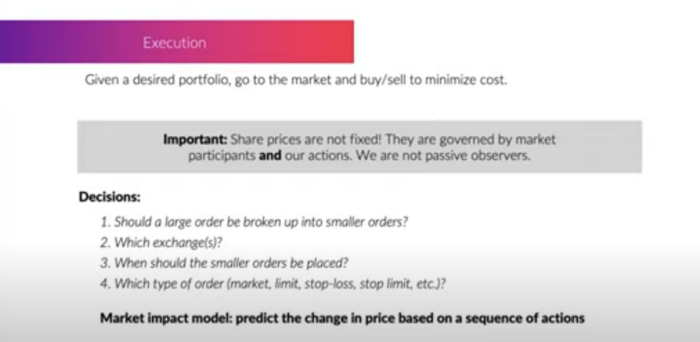

Finally, at execution level, it’s also critical to predict the future price so as to control the cost. Different from feature extraction and alpha modeling, which focus more on relative long-term return, execution tends to focus on short-term price dynamics and deal with buy and sell the suitable amount of quantity.

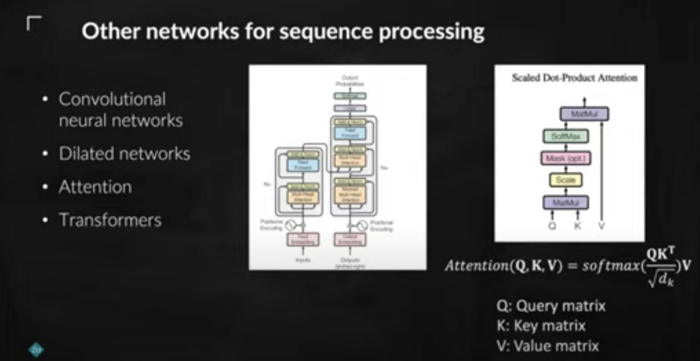

In the second half, David introduces the following models:

- Recurrent Neural Network (RNN)

- Long Short-Term Memory (LSTM)

- Attention

- Transformer

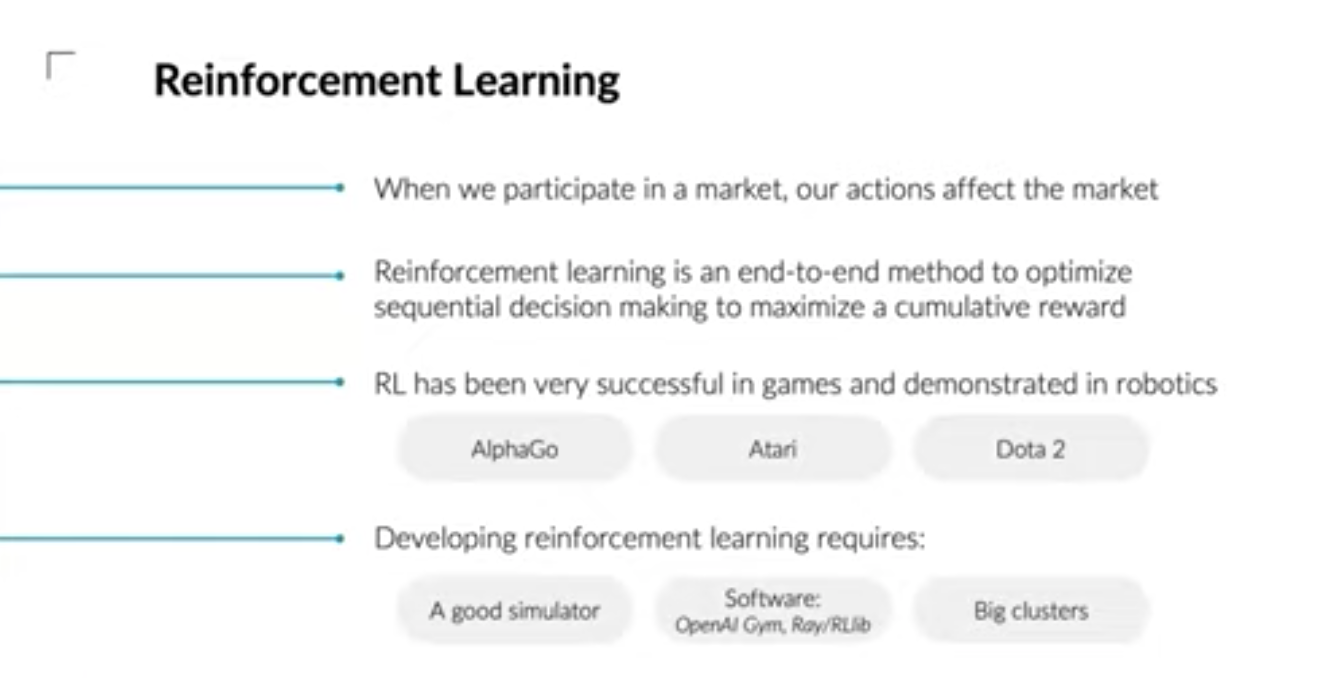

The presentation also briefly covers some application of reinforcement learning, which has made huge success in gaming and robotics but it is still too early to tell if how powerful it will be in quant finance field.

In summary, we can see that in the top hedge funds such as Two Sigma:

- Many parts of the investment pipeline require inference over sequence and thus, deep neural networks can be trained to be helpful

- It’s important to keep the traditional investment framework and identify areas to implement deep learning models

- Software infrastructure (such as distributed systems) and lots and lots of data are equally important.

轉貼自Source: medium.com

若喜歡本文,請關注我們的臉書 Please Like our Facebook Page: Big Data In Finance

留下你的回應

以訪客張貼回應