摘要: Flash forward to 2021, and assets in U.S. sustainable funds totaled more than $304 billion as of June, according to Morningstar. And the importance of environmental and social issues since the Covid-19 pandemic has increased more for US investors that their global counterparts according to Schroders’ annual Global Investor Study.

▲圖片來源:pixabay.com

Back in 2015 Traders Magazine wrote that Wall Street wanted to care but there was a debate over whether environmental, social and government strategies meant sacrificing returns.

The article, published more than six and a half years ago, was the first article about ESG to ever appeared on Traders.

Numbers at the time were comparatively modest. From the article: “Investing with a conscience is gaining ground. In the U.S., sustainable, responsible and impact investing has grown to $6.57 trillion in U.S.-domiciled assets under management at the start of 2014, according to the Forum for Sustainable and Responsible Investment, also known as US SIF Foundation. That’s a 76 percent rise from $3.74 trillion under management at the start of 2012.”

Flash forward to 2021, and assets in U.S. sustainable funds totaled more than $304 billion as of June, according to Morningstar. And the importance of environmental and social issues since the Covid-19 pandemic has increased more for US investors that their global counterparts according to Schroders’ annual Global Investor Study.

The survey found that since the pandemic 60% of US investors said investment managers and major shareholders should be responsible for mitigating climate change, compared with 53% of investors globally. A similar percentage, 63%, thought that investment managers and major shareholders should be responsible for mitigating social inequality compared with 55% globally.

Schroders’ Global Investor Study surveyed more than 23,000 investors, including 1,500 in the U.S.

Sarah Bratton Hughes, head of sustainability, North America, at Schroders, said in a press briefing that Americans are more likely to invest in sustainable funds because of their societal principles, in addition to believing they are more likely to offer higher returns.

“Although climate tends to get many of the headlines, in the US we have investors that care just as much, if not more, about investing in funds that are acting responsibly on social issues such as human capital management, diversity and inclusion, and supply chain management as they do on the environmental side,” she added.

Bratton Hughes admitted there are data challenges in environmental, social and governance investing, especially on social issues, but she believes this will improve in a similar fashion to climate-related data. For example, the European Union is consulting on human capital management and social issues in the next wave of the region’s ESG taxonomy, after issuing environmental guidelines first.

“In the US indications are that policy makers will look at human capital management alongside climate change,” she added.

Return

Schroders’ survey last year was a turning point according to Bratton Hughes as it was the first time that the majority of Americans were investing sustainably in order to improve returns.

She said: “From a US investor perspective they’re really looking at sustainable investing from a value creation perspective.”

As a result ‘greenwashing’ of sustainability performance is a major concern for US investors. Bratton Hughes believes these concerns will be addressed through certification of sustainable activities by third parties, such as happens in Europe, and guidance on ESG disclosures from US regulators such as the US Securities and Exchange Commission.

“The trend is clear from a US perspective that clients want to ensure that if they’re invested in a fund that is labelled ESG, sustainable, responsible or green, that they are achieving that outcome alongside their return targets,” she added.

Policy

Bratton Hughes continued there is a perfect backdrop for sustainable investing due to three drivers – client demand; improved performance and an explosion in sustainable policy which has doubled over the last two years.

American sustainability policies have been lagging the rest of the world but President Biden made the US rejoin the Paris climate agreement and named John Kerry as the US Special Presidential Envoy for Climate, a new position on the National Security Council. In addition Brian Deese, who leads the National Economic Council, was previously head of sustainable investing at BlackRock.

The previous administration had proposed regulatory changes from the Department of Labor that would limit the use of ESG in ERISA plans – pension schemes governed by the Employee Retirement Income Security Act of 1974 – which were opposed by the asset management industry, but this was frozen under President Biden and could be reversed.

“A change in DOL policy would open up a massive part of the market to sustainability driven funds,” said Bratton Hughes.

Divestment

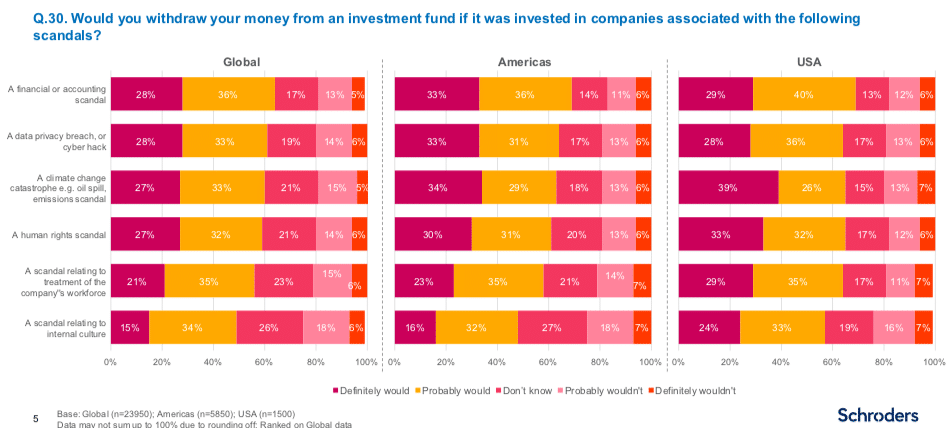

In the survey Americans were also more likely than investors globally to want to withdraw funds from companies involved in scandal. For example, US investors were particularly concerned with treatment of a company’s workforce, with 65% of respondents saying they would withdraw funds from a company experiencing this type of scandal, compared to 56% of global investors.

▲圖片來源:tradersmagazine.com

“We see sustainable investing as a value driver for companies so we tend to be more focused on active ownership and engaging with investors,” said Bratton Hughes.

Schroders had more than 2,000 engagements last years across 58 countries.

Passive investing

There has also been a growth in passive ESG funds and products. FTSE Russell has introduced six Russell ESG indexes tracking the underlying Russell 1000, 2000 and 3000 benchmarks.

London Stock Exchange Group’s data and index arm said $550bn assets under management are now in US ESG/SRI funds, an 88% increase since 2018, leading to new index developments, sustained inflows into passive ESG funds, and the mainstreaming of ESG into passive investing.

The Russell US indexes currently capture 98% of the US investable market capitalization and are tracked by $10.6 trillion in passive and active funds.

The ESG screened versions are for investors who want to remove harmful products or controversial activities such as weapons, firearms, tobacco and fossil fuels while maintaining broad US market exposure. They also incorporate sustainability issues by targeting specific ESG score improvement versus the benchmark.

Tony Campos, head of sustainable investment, Americas at FTSE Russell, said in a statement: “When it comes to sustainable investment, choosing an appropriate index truly matters. The Russell US ESG Indexes was developed for investors looking to incorporate sustainability considerations within a broad market portfolio without impacting the risk and return characteristics of the headline benchmark.”

ESG futures

In the derivatives market CME Group said in a statement it is experiencing significant growth in open interest for S&P ESG index futures in US and Europe.

On 14 September CME had a record volume day for the S&P 500 ESG index futures of 18,075 contracts (over $3.4bn notional) which contributed to record open interest of 22,073 contracts ($4.2bn notional) on the same day.

There have also been inflows into the new S&P Europe 350 ESG index futures with 315 contracts trading, taking open interest up to 365. The instrument was launched on 24 May 2021.

Tim McCourt, global head of equity index and alternative products at CME Group, said in a statement: “As the ESG market continues to evolve, there is a growing client need for sophisticated forward-looking ESG products. The sharp uptick in open interest is indicative of the market’s desire for ESG instruments with a strong index methodology and flexibility.”

轉貼自Source: tradersmagazine.com

若喜歡本文,請關注我們的臉書 Please Like our Facebook Page: Big Data In Finance

留下你的回應

以訪客張貼回應