摘要: In DEFI 1.0 and yield farming, the liquidity provider will receive an ERC(BEP)-20 token as a mathematical proof of the loan to the bank. Holding the LP tokens will guarantee that the investors will get their assets back. What Sigmoid propose is to instead of issuing an ERC(BEP)-20 LP token, we will give the provider a ERC(BEP)-659 bond when deposit.

▲Lydians thought to be one of the first adopters of money. Other countries and civilizations soon began to mint their own coins with specific values.

(來源:medium.com)

Why Money?

One can argue about if money has been invented, or it appears spontaneously as one good is universally recognized as a medium of indirect exchange. In a barter economy, the role of a measure of value of all goods is absent. To effectuate any exchange, two individuals must have the good or service that the other one needs; thus the marginal considerations bring a slight increase and diminution of the utility of certain good or service, making the exchange possible.

When the division of labor increases the need of indirect exchange, money appears. From precious metal to government issued cash, the first goal is to facilitate any indirect exchange, and if that will occur, provide a more obvious way to represent how a good or service is needed in a society.

The presumption, that money is a commodity which economic function is to facilitate the interchange of goods and services, can’t explain why inflation is needed in any growing economy.

Where the supply of money must compensate for the growth of the need for exchange. In the words of Messis, Money as a credit of transactions is in fact nothing but the exchange of present goods or services against future goods or services.

The issues of the measurement of objective use-value of a commercial good, demonstrate the necessity of an universal Price-index. The objective exchange value of a given commodity is expressed by how much this individual is willing to pay in money. When the exchanges are carried mainly by means of money and credit, nearly all goods and services have a price expressible in number. This appochement makes possible the money to become a medium expressing the average marginal values of a commodity. Any technical or social development, leads to the revision of the valuation.

In the terms of Austrian economists, the demand/supply ratio of a good or service can be expressed by their exchange value in a common medium of exchange. The medium in question is exchangeable for every commodity and with which every commodity can be purchased. Because the marginal value itself is an irrational presumption tainted with human biases; any individual, even if he was an established economist, can’t calculate how a good will be needed in the nearest future. in Menger’s words. The whole structure of the calculations of the entrepreneur and the consumer rests on the process of valuing commodities in money. Money has thus become an aid that the human mind is no longer able to dispense with in making economic calculations

In that sense, we believe that the supply of money should be as a result of the market operations, not the cause of it. By any intervention of diluting the market, administrative bias blurs the price index and by doing so brings more crises in the future.

DEFI 1.0 and the mercenary problem

▲Don’t buy Meme(來源:medium.com)

Money was never allowed to develop further after it’s invention. Originated in his original from, frozen at his most primitive state. And if we see any innovation, is that how they abuse and exploit their monopoly on money. What Hayek says in his later book, The denationalization of money.

The demand for the freedom of the issue of money will at first, with good reason, appear suspect to many, since in the past such demands have been raised again and again by a long series of cranks with strong inflationist inclinations.

Bitcoin stated as an electronic cash system has failed his task. In any sens we can only consider Bitcoin as a virtual good, which value is most volatile. To become a medium of indirect exchange, the value of which must be relatively stable. This need of a stable currencies make the apparition of the first generation stable coins, such as USDT and USDC. What Fiat currency backed stable coins have accomplished so far brings no solution to the Economic calculation problem.

yield farming wish to create a use case of digital currencies. When liquidity providers deposit digital currencies into the liquidity pool, they are effectively lending a loan to the bank. In return, Yield farming protocols will reward the providers with interest and units of their own token.

The protocols lure the investors to keep their token, by giving them more. What dangers about this, is what we called mercenary problem. The early liquidity provider works like mercenaries, attracted by the high interest rate of Yield farming. The protocol will use the liquidity of the mercenaries to attract more investors. When the first liquidity provider can’t gain more interest from the protocol, they will simply take their liquidity away from the IP and sell all the rewarded protocol token. Like during the Dutch Tulip mania, when the market starts to show the indices of recession, the inevitable collapse happens spontaneously.

What the early algorithmic stable coins came so far, is simply force the value of their protocol token to be stable. Protocols like ESD and Basis Cash did not bring any solution to solve the mercenary problem. Being stable, meaning that the early protocols can only issue more token to prevent the early investors from selling their early reward. By doing so will only create more inflation and despair among the investors. We believe that the value of a token should be the result of the Supply and demand, not the reason of it. In our early article The Future of algorithmic stablecoins, we explains that:

The Quantity Theory of Money tells of how the price level is determined and why it might change over time. The quantity of money available in the economy determines the value of money, and consequently the primary cause of inflation is the growth in the quantity of money

- Basically we have M V = P Y

where: V = velocity; P = the price level; Y = the quantity of output; M = the quantity of money

The quantity equation relates the quantity of money (M) to the nominal value of output (P x Y). The quantity equation shows that an increase in the quantity of money in an economy must be reflected in one of three other variables: the price level must rise, the quantity of output must rise, or the velocity of money must fall.

The velocity of money is relatively stable over time. So when the central bank changes the quantity of money, it causes proportionate changes in the nominal value of output (P x Y); That is, the general price rises as money does not affect real output (because money is neutral) and so we have inflation.

When a token raises market cap by issuing more, it is said to levy an inflation tax. An inflation tax is like a tax on everyone who holds that token.By giving them more to compensate for their loss, will only accelerate the loss of confidence.The Fisher effect refers to a one-to-one adjustment of the nominal interest rate to the inflation rate.

DEFI needs a medium of indirect exchange. In order to be self-stable, the early stablecoin protocols use voluntary supply expansions and contractions around a Time Weighted Average Price (TWAP) oracle from the incentive trading pool on AMM. (more about this can be fond on uniswap v2 Oracles doc).

This intervention by protocol interferes the expression of market need in the form of it’s market price. The crucial factors in the Economic calculation problem is the objective exchange value of money. However the objective value of the algorithmic stable token is determined by some form of collateral. The subjective value of individuals should be allowed to express itself. This basis of the value is necessary for the protocols to central the minting policy. the supply of money should be as a result of the market operations, not the cause of it. By any intervention of diluting the market, administrative bias blurs the price index and by doing so brings more crises in the future.

DEFI 2.0 and Sigmoid

▲來源:medium.com

In DEFI 1.0 and yield farming, the liquidity provider will receive an ERC(BEP)-20 token as a mathematical proof of the loan to the bank. Holding the LP tokens will guarantee that the investors will get their assets back. What Sigmoid propose is to instead of issuing an ERC(BEP)-20 LP token, we will give the provider a ERC(BEP)-659 bond when deposit. The ERC(BEP)-659 bond has more parameters, which allow more sophisticated allocation systems to be created. For more information about ERC(BEP)-659 bond standard can be fond here, ERC(BEP)-659 Multiple Callable Bonds Standard Proposal

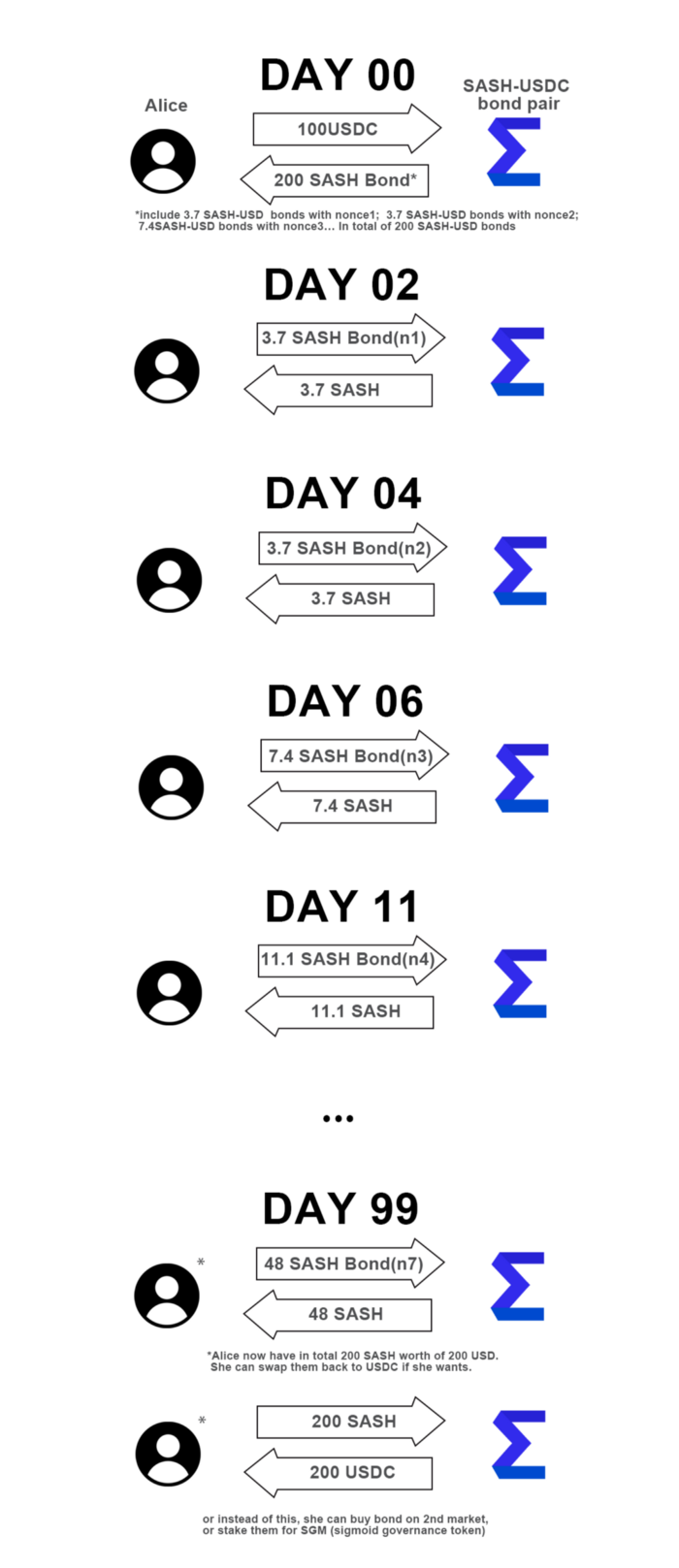

In an example we will explain how this will function:

Imagine that Alice has 100 USD invested into SASH-USDC bond. The 100 usd will be transferred to SASH-USD AMM pair contract, as a pledge of the value of SASH. Alice will immediately receive 200 SASH-USD bonds( include 3.7 SASH-USD bonds with nonce1; 3.7 SASH-USD bonds with nonce2; 7.4SASH-USD bonds with nonce3…)Those bonds are not an ERC(BEP)-20 token, each bond has a nonce and a set of redemption conditions. In the example of SASH-USD bond, it has different redemption dates.

2 days later, Alice can redeem 3.7 SASH-USD bond with bond nonce1. When redeemed Alice will be paid in SASH, and from the pair contract Alice can swap 3.7 SASH back to USDC if she wants.

4 days later, Alice can redeem another 3.7 SASH-USD bond with bond nonce2.

6 days later, Alice can redeem 7.4 SASH-USD bond with bond nonce3.

11 days later, Alice can redeem 11.1 SASH-USD bond with bond nonce3

…

until the 99 days, Alice received in total 200 SASH worth of 200 USD.

▲來源:medium.com

ERC(BEP)-659 enables any token to issue their own bonds, and allow those bonds to be read and traded on a secondary market. Bond issuer will gain more control on the conditions of redemption. The competition of bonds will allow the market to find a better suited allocation system.

We believe that this bond mechanism is the answer to the mercenary problem. Before providing the liquidity, the mercenaries( liquidity providers) sign a commitment that they must obey. Mercenaries though still lured by profit, now must grantee their service (liquidity providing) for the protocol.

In the case of SASH-USD bonds, the minting of SASH is baked by USD. Their will be no limit for the total supply of SASH. Liquidity providers will see the profit rate remains the same from the beginning. And because of the partial collateral of USD, the price of SASH is guaranteed.

Buying SASH-USD bonds is not exactly like locking liquidity for pair. The bonds that can’t be redeemed now, can be traded on a secondary market. The price of the bond is decided by market. So during a recession, the low market price of bonds will allow the big players to purchases them in a large scale. On Sigmoid Bonds DEX, every ERC(BEP)659 bond can only be traded with SASH. This will also create the market demand for SASH. When the market shows any sign of recovery, new money will be pulled into the bond market. The old bond can then be redeemed, and the market will recover from the recession. For more about this, please read The Future of algorithmic stablecoins.

轉貼自Source: medium.com

若喜歡本文,請關注我們的臉書 Please Like our Facebook Page: Big Data In Finance

留下你的回應

以訪客張貼回應