摘要: New data from Whalemap reveals three whale clusters around $12K that should act as support and resistance areas for Bitcoin price in the short term.

▲圖片標題(來源:Whalemap.io)

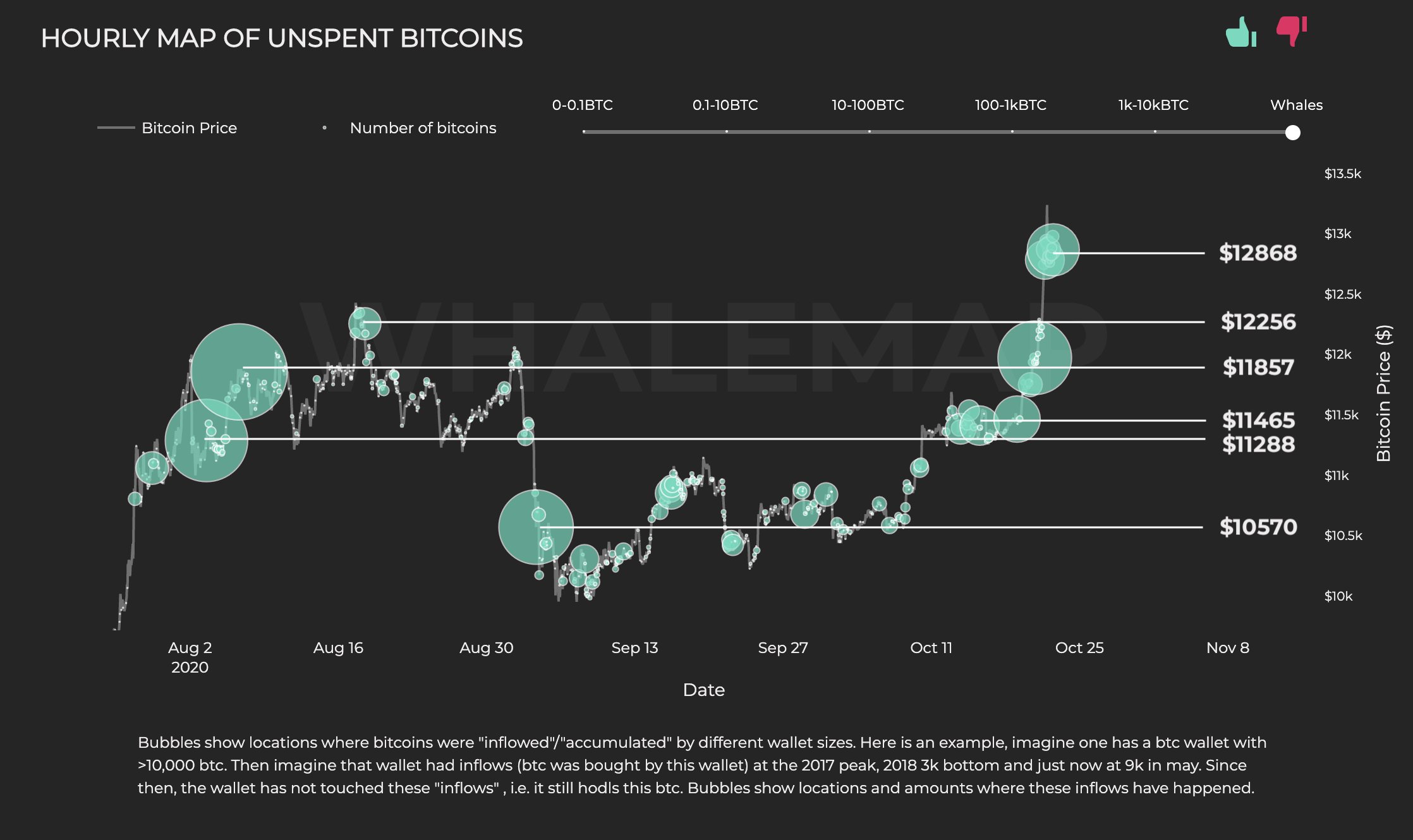

According to Whalemap, there are three major Bitcoin (BTC) whale clusters in the near term that might serve as key technical levels. The $11,857, $12,256 and $12,868 levels would likely act as important support and resistance areas.

In previous cycles, whale activity coincided with significant price movements at crucial technical levels. For instance, Cointelegraph reported that a whale sold at $12,000 after “HODLing” for years. In the next few weeks, BTC dropped to sub-$10,000.

What are whale clusters and why are they important?

Whale clusters form when whales buy Bitcoin and do not move their BTC holdings. This indicates that whales are accumulating BTC in the areas where the clusters materialize.

The larger Bitcoin whale cluster has formed at $11,857, with previous clusters at $11,288 to $11,465. In the near term, that signifies that the $11,857 is considered a big support area by whales.

Now, Bitcoin would have to remain above $11,857 or consolidate above it to see a broader rally. The ideal technical structure for a rally continuation would be to stabilize at $11,900.

After a major rally, some consolidation to neutralize the futures market could make the ongoing uptrend healthier.

Since Oct. 2, in just over three weeks, the price of Bitcoin climbed 24% against the U.S. dollar. In the same period, gold has slightly risen by 0.2%, as BTC outperformed most risk-on and safe-haven assets.

詳見全文: cointelegraph

若喜歡本文,請關注我們的臉書 Please Like our Facebook Page: Big Data In Finance

留下你的回應

以訪客張貼回應